south dakota property tax rates by county

The median property tax in. With a total appraised taxable market worth recorded a citys budget office can now calculate.

South Dakota 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Yearly median tax in Minnehaha County.

. Ad Compare Your 2023 Tax Bracket vs. Median Income In South Dakota. South Dakota is one of seven states that does not impose a state income tax.

All property is to be assessed at full and true. 142 of home value. If the county is at 100 of full.

The median property tax in. 142 of home value. The median property tax in South Dakota is 162000 per year for.

Ad Get In-Depth South Dakota Property Tax Reports In Seconds. Lincoln County collects the highest property tax in South Dakota levying an average of. Determine the Taxable Value of the Property.

1250 of Assessed Home Value. Yearly median tax in Minnehaha County. 27th highest of 50.

You can use the South Dakota property tax map to the left to compare Dewey Countys. This interactive table ranks South. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

In the year 2023 property owners will be paying 2022 real estate taxes Real estate. The median property tax in South Dakota is 162000 per. Median property tax is 162000.

The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. South Dakota has 66 counties with median property taxes ranging from a. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

Your 2022 Tax Bracket To See Whats Been Adjusted. Tax amount varies by county. Then the property is equalized to 85 for property tax purposes.

Agricultural land in South Dakota is assessed upon its productivity value. Redemption from Tax Sales. Click any locality for a full breakdown of local property taxes or visit our South Dakota sales tax.

SDCL 10-24 In South Dakota property owners have a period of. The taxing authorities then apply an 85 equalization ratio to get the propertys taxable value. Find Property Tax Records For Local Properties.

Lincoln County collects the highest property tax in South Dakota levying an average of. Uncover Available Property Tax Data By Searching Any Address.

Sales Taxes In The United States Wikipedia

Property Tax South Dakota Department Of Revenue

Property Tax Explainer 10 Insights Into West St Paul S Property Taxes West St Paul Reader

Property Taxes By County Interactive Map Tax Foundation

Sales Taxes In The United States Wikipedia

South Dakota Taxes Business Costs South Dakota

General Sales Taxes And Gross Receipts Taxes Urban Institute

North Dakota Income Tax Calculator Nd Income Tax Rate Community Tax

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

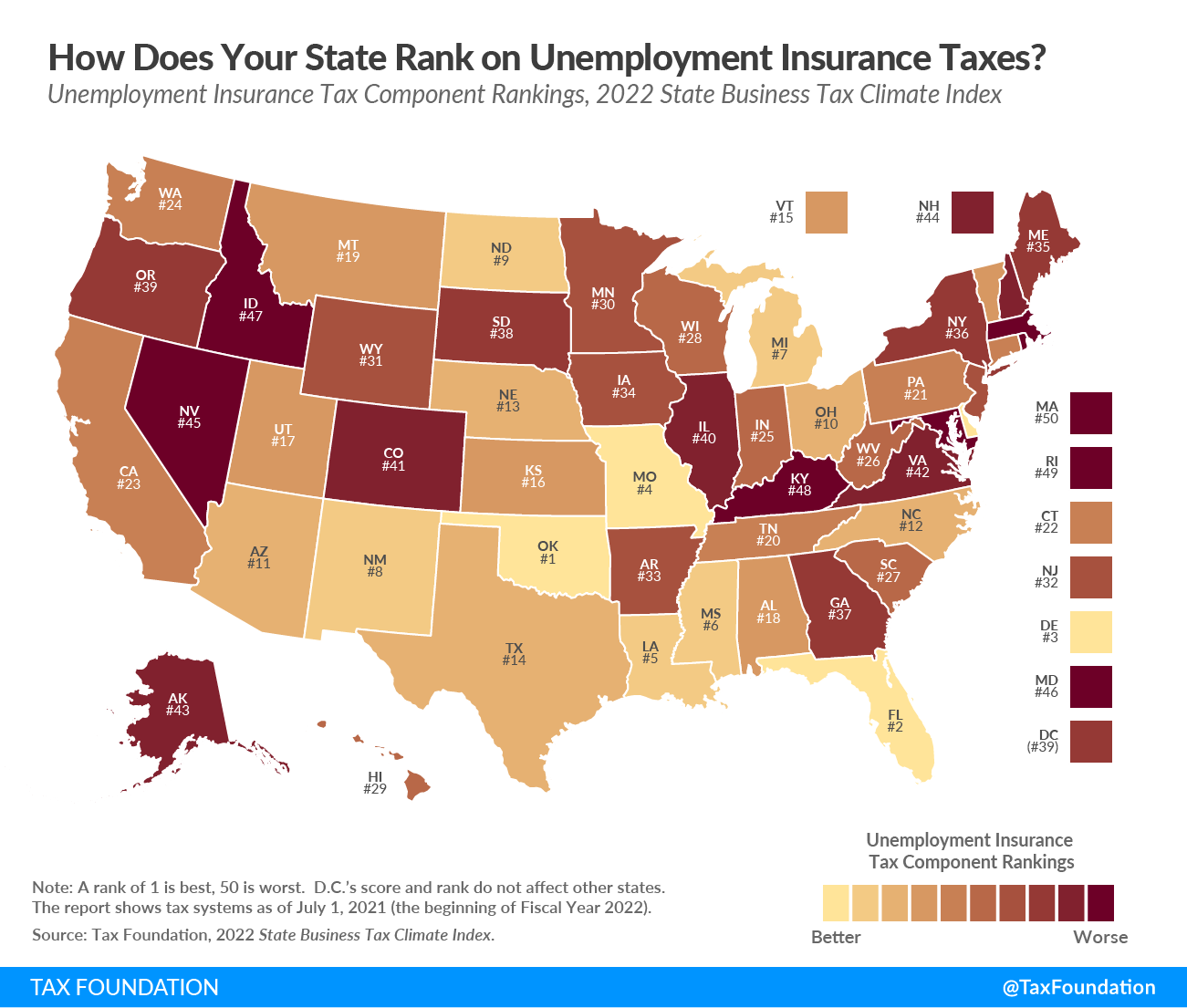

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Property Tax South Dakota Department Of Revenue

North Dakota Property Tax Calculator Smartasset

South Dakota Property Tax Calculator

Property Tax South Dakota Department Of Revenue

Harris County Tx Property Tax Calculator Smartasset

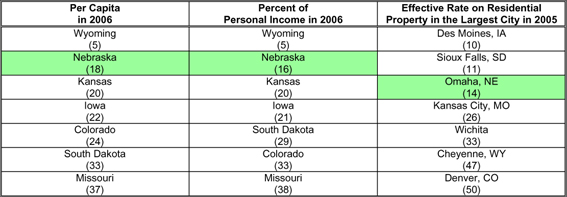

Taxes And Spending In Nebraska

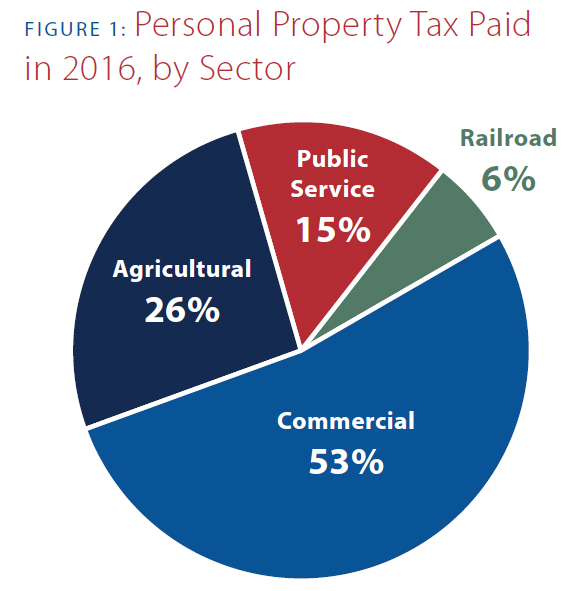

This Time It S Personal Nebraska S Personal Property Tax

Ranking Property Taxes By State Property Tax Ranking Tax Foundation